Top Downloading App BHIM is Not Free – Says Users

BHIM is different to mobile wallets such as Paytm and MobiKwik as it also allows sending money to people who don’t have the app.

Prime Minister Narendra Modi announced the digital payments app BHIM from National Payments Corporation of India (NPCI) and it is now the top free app on Google Play Store. The digital payments app which brings a singular app for all UPI-based payments was unveiled on December 30 and in just three days climbed to top of the charts.

BHIM app has been downloaded more than 1 million times and has a 4.2 rating on the Play Store. Interestingly, the app has received reviews from more than 86,000 users in just over three days of its launch. Remember, BHIM app is only available for Android users.

Indigenous digital payments app BHIM has been downloaded 3 million times and enabled over 5 lakh transactions since its launch, Niti Aayog CEO Amitabh Kant said.

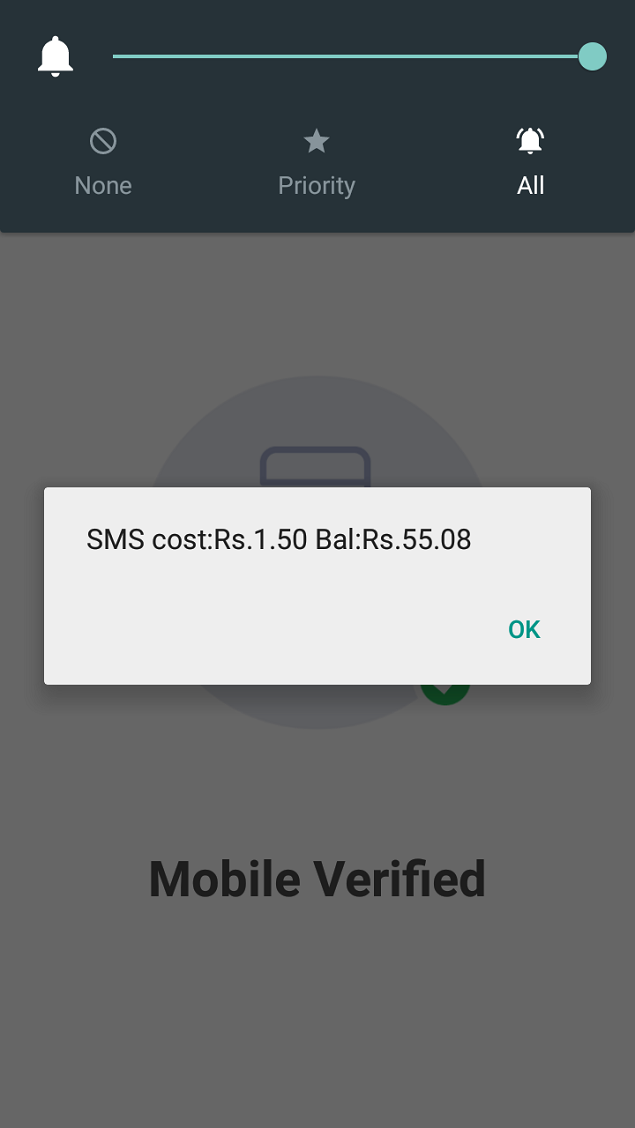

However, users noticed that the so-called ‘free’ app deducts Rs 1.50 from their mobile phone balance. When the app is downloaded, users receive a verification code, and the amount is instantaneously deducted from the balance.

According to complaints, transactions fail even after completing this procedure. Furthermore, contrary to its claims of facilitating offline transactions, the app seems unable to do do without internet connectivity.

WATCH VIDEO | HOW TO DOWNLOAD & INSTALL

TOP 5 Secrets Of BHIM APP – Here’s All You Need To Know

1. BHIM is a digital payments solution app based on Unified Payments Interface (UPI) from the National Payments Corporation of India (NPCI). The app allows users to send or receive money to other accounts using UPI or via IFSC and MMID code as well. You can make direct payments to merchants by scanning QR code.

2. Users can send money to their friend or family even if they don’t have the BHIM app, as it is linked directly to a bank account. A maximum of Rs 10,000 can be shared per transaction, and a total of Rs 20,000 can be sent within 24 hours.

3. A number of banks support the BHIM app.

The list includes

- Allahabad Bank,

- Andhra Bank

- Axis Bank

- Bank of Baroda

- Bank of Maharashtra

- Canara Bank

- Catholic Syrian Bank

- Central Bank of India

- DCB Bank

- Dena Bank

- Federal Bank

- HDFC Bank

- ICICI Bank

- IDBI Bank

- IDFC Bank

- Indian Bank

- Indian Overseas Bank

- IndusInd Bank

- Karnataka Bank

- Karur Vysya Bank

- Kotak Mahindra Bank

- Oriental Bank of Commerce

- Punjab National Bank

- RBL Bank

- South Indian Bank

- Standard Chartered Bank

- State Bank of India

- Syndicate Bank

- Union Bank of India

- United Bank of India

- and Vijaya Bank

4. BHIM lets you choose your preferred bank after it has verified your mobile number. The app will then ask you to set a passcode (4 digit), which you can choose. You will need this code every time you open the app. The UPI pin will needed to authenticate the transaction.

5. BHIM will support Aadhaar-based payments as well. The feature is supposed to go live soon. Once launched, users will be able to make transactions with a fingerprint impression.

BHIM is different to mobile wallets such as Paytm and MobiKwik as it also allows sending money to people who don’t have the app. The government has also rolled out UPI integration to USSD payments, which can work on feature phones and offline as well.

(Source: India Express Blog, Times of India Blog)